I’m very interested in understanding the Hispanic market research in the US and its impact on us as marketers. This post is from the Nielsen Wire, and really demonstrates why we all need to be paying attention today to the rapidly growing Hispanic market.

More than 52 million strong and representing the majority of population growth over the next five years, Latinos have become prominent in all aspects of American life. A growing, evolving population, Latinos are a fundamental component to future business success, with a buying power of $1 trillion in 2010 that is projected to grow 50 percent to $1.5 trillion in 2015.

More than 52 million strong and representing the majority of population growth over the next five years, Latinos have become prominent in all aspects of American life. A growing, evolving population, Latinos are a fundamental component to future business success, with a buying power of $1 trillion in 2010 that is projected to grow 50 percent to $1.5 trillion in 2015.

In State of the Hispanic Consumer: The Hispanic Market Imperative report, Nielsen has identified several unique circumstances that combine to make Hispanics the largest population group to exhibit culture sustainability—ever. Borderless social networking, unprecedented exchange of goods, technology as a facilitator for cultural exchange, retro acculturation, and new culture generation combine to enable Hispanic culture in the U.S. to be sustainable. In other words, Hispanic culture may evolve but will not go away.

For businesses, this makes understanding Hispanic consumers essential. Key findings of The Hispanic Market Imperative include:

- The overall U.S. population is graying, but the Latino population remains young and the primary feeder of workforce growth and new consumption. The median age of the Latino population is 28 years old, nearly ten years younger than the total market median age of 37 years. Given that the age for a new home buyer is between 26 and 46 years old, Latinos will become a force in residential purchasing over the next ten years.

- Technology and media use do not mirror the general market but have distinct patterns due to language, culture, and ownership dynamics. For example, Hispanics spend 68 percent more time watching video on the Internet and 20 percent more time watching video on their mobile phones than non-Hispanic whites.

- Latinos exhibit distinct product consumption patterns and are not buying in ways that are the same as the total market. Hispanics make fewer shopping trips per household than non-Hispanics, for instance, and spend more per trip.

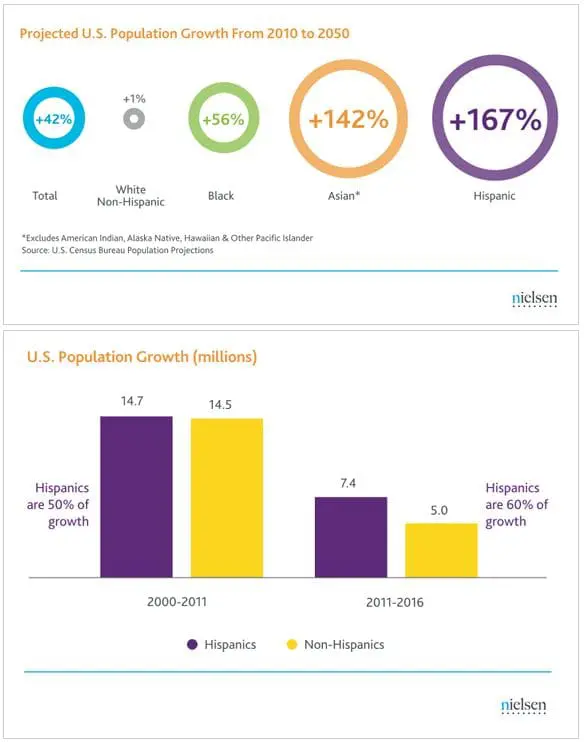

- Rapid Latino population growth will persist. Between 2000 and 2011, Hispanics accounted for more than half of the U.S. population increase; in other words, their 10-year increase was slightly greater than that of all other non-Hispanics combined. Hispanics will contribute an even greater share (60 percent or higher) of all population growth over the next five years.

- Hispanic culture is sustainable. A 2011 national survey of Hispanic adults found that nine out of ten Hispanic parents and parents-to-be want their children to be able to speak Spanish, even though they also want them to become fluent in English.